What is a Fractional CxO?

Fractional CxOs Offer C-Suite Expertise at a Fraction of the Cost

It takes more than a great product to successfully scale and grow a company. You also need experienced leaders to help you navigate various stages of the business life cycle and make sure no detail is overlooked. But most early-stage companies don’t have the budget to hire full-time C-Suite–level staff needed to grow a budding company.

This is where fractional CxOs—or Chief [blank] Officers—come in.

What Are Fractional CxOs?

What Are Fractional CxOs?

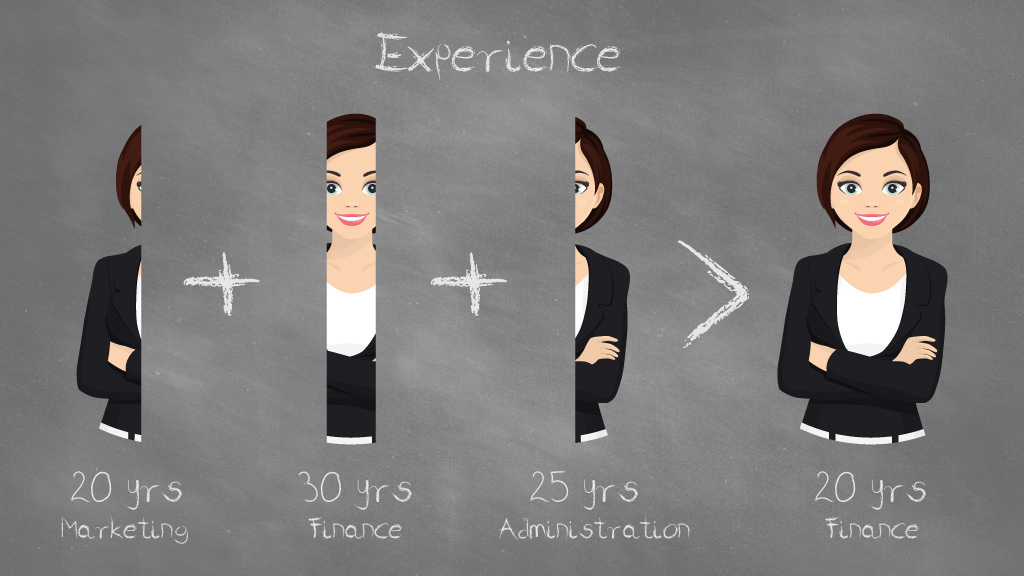

Fractional CxOs are typically established C-Suite leaders with decades of corporate experience who fill executive roles on a long-term contract, or retainer basis—giving growing companies access to skilled executives, at a fraction of the cost, and allowing company founders more time to focus on what they do best.

Unlike consultants, who advise on a particular project and are invested in the success of the project but not the success of the whole company, fractional resources become ingrained in the company’s culture and are personally invested in seeing the company succeed.

Fractional CxOs guide growing companies through the business life cycle, from startup to maturity. Fractional resources who are a great fit for your company could become long-term part-time outsourced resources. Or they can help establish permanent teams and departments, assuming they truly are fractional and don’t have any desires to get in on a more permanent basis.

Because Sommet Strategies offers fractional CFO services, in this post we will focus on how fractional CFOs can help early-stage companies achieve their business goals.

Do I Need a Fractional CFO to Grow My Company?

If your long-term vision for your startup or early-stage company includes growth or acquisition, the answer is YES!

Early-stage companies typically have a limited budget, and hiring a full-time employee at a bargain salary and expecting them to perform as a high-level CFO just won’t happen.

You could bring in an experienced startup consultant or pro bono advisor to ask questions, offer strategic advice, and make recommendations, and that’s, perhaps, good enough. But these types of advisors often do little to execute those recommendations or manage other issues that arise. That’s what makes fractional CxOs invaluable—they stick around and see the company through the execution.

The do-it-yourself approach is risky as well. Sure, you and your cofounders could read business books, take online courses, or get advice from friends or colleagues who’ve built successful businesses, but you’d be exhausting your time and mental powers outside your zone of genius trying to cobble together solutions, and hoping you didn’t miss anything. Fractional CxOs focus 90% of their time on their specialty area, allowing founders to spend their time doing what they do best, maximizing efficiency for everyone.

How a Fractional CFO Can Help You Fulfill Your Vision

Founders who are looking to grow their companies know they need someone to help with the financial aspects—an accountant to close the books and report the financials. However, strategic financial planning is not the same as accounting.

A CFO can offer more high-level financial expertise to help you put the right systems, processes, and people in place as your company grows and changes. In addition to developing financial models to drive capital planning, budgeting, and forecasting, a CFO can

● Develop and execute financial strategy

● Perform financial and legal due diligence

● Develop financial projections, company valuations, and facilitate 409a valuations

● Advise and negotiate on debt agreements and investor term sheets

● Establish pricing strategy and collaborate on business development goals

You could fumble through some basic financial projections yourself, but the high-level strategic financial details should be left to a strategic partner who can go beyond the basic tactics to expertly tailor the right strategic financial targets needed for your company to grow and thrive.

Fractional CFOs have vast experience specializing in the finance and are continually building on that experience. A good fractional CFO will also bring along an ever-evolving network of resources they can tap for additional support to form a highly experienced leadership team who can collaborate to create a solid business plan and a detailed financial strategy. All of which increases the company’s value in the eyes of an investor.

When you’re ready to raise capital or approach investors, having a fractional CFO on your team can be the difference between good enough and exceptional!

Strategy Vs. Tactics

What is a Fractional CxO? Strategic Planning – So Simple Yet Still So Misunderstood An internet search for Strategic Planning or Business Strategy will lead

Kick A$% Presentations

You can easily find graphic designers to make the deck more visually appealing. You follow the recipe perfectly, you feel you have a great-looking deck with a smooth, logical story flow.

But then you hear, “NO”.

And then you hear NO again, and again, and again.